Minister of Rural Economic Development Transition Book (October 2019)

Overview of Rural Economic Development

- Welcome to Infrastructure Canada

- Overview of Rural Economic Development

- What we Heard: Key Issues/Themes

- Key facts about Rural Canada

- Overview of Rural Canada

- Broadband Overview

Welcome Letter

Minister of Rural Economic Development

The House of Commons

Ottawa, Ontario K1A 0A6

Dear Minister,

Please accept my congratulations on your appointment as Minister of Rural Economic Development. On behalf of the Infrastructure Canada team, I would like to welcome you to the Department. We are here to provide you with evidence-based, non-partisan advice, and support you in delivering your important mandate.

Rural and small communities are an important contributor to the national economy, generating nearly 30 percent of Canada’s Gross Domestic Product. Small town and rural Canada also represent a major component of Canada’s population, and are where almost 20 percent of Canadians live and work.

There currently exists a wide array of programs and policies to support rural Canada, delivered across a significant number of federal departments and agencies, including the Regional Development Agencies located across Canada. Provinces, territories, municipalities, academia, the private sector and Indigenous organizations are also actively engaged in rural economic development.

As Minister of Rural Economic Development, you will have a real opportunity to better the lives of rural Canadians. You will hear directly from Canadians living and working in rural Canada, and gain an even stronger appreciation for their challenges, concerns, and areas of opportunity. Your voice at the Cabinet table will also be an important element in ensuring that rural perspectives are considered in federal decision-making.

Sincerely,

Kelly Gillis

Deputy Minister

Infrastructure Canada

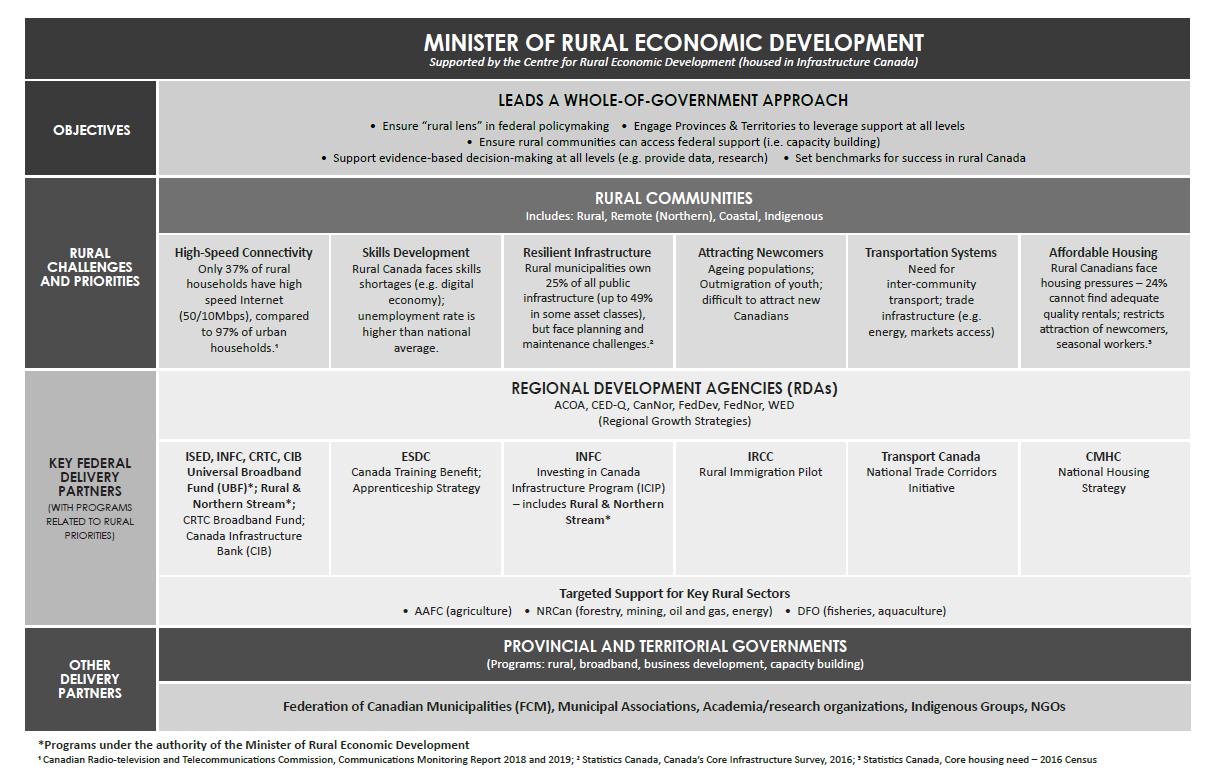

Overview of Rural Economic Development

Overview of Rural Economic Development

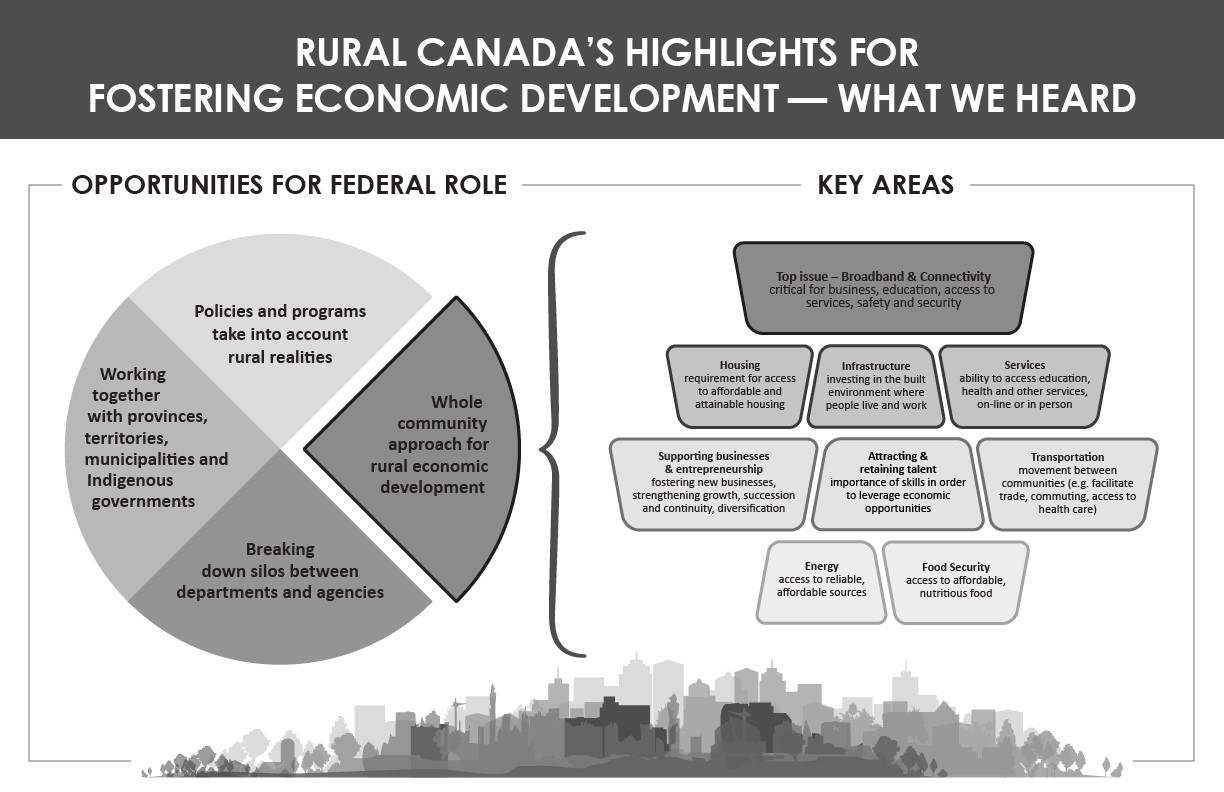

What We Heard: Key Issues and Themes

What We Heard: Key Issues/Themes

Key Facts About Rural Canada

Overview

- Rural Canada is diverse in terms of its demographics, geography, proximity to larger urban centres and economic opportunity.

- Approximately 20 percent of Canadians live in small communities (populations of 1,000 – 29,999) and other rural or remote areas.

- Nearly 30 percent of Canada’s Gross Domestic Product (GDP) is generated by those living and working in the small communities and rural areas outside of Canada’s medium and large urban centres.

Demographics

- Canadians in rural areas are slightly older than the Canadian population as a whole – except in Nunavut, which has a young and growing population.

- GDP per capita is approximately 9 percent higher in rural areas compared to larger urban areas.

- Rural communities tend to report a higher life satisfaction score and sense of community belonging than urban areas.

- Rural communities are more likely to have a significant Indigenous population, and fewer immigrants settling in rural communities compared to urban areas.

- Rural Canadians are half as likely as urban Canadians to have a university degree, and are more likely to be in a trade.

Key Issues

- Internet connectivity: In 2018, only 37 percent of rural households have access to high-speed Internet (50/10Mpbs) compared to 97 percent in urban areas. Recent broadband investments are improving this variance with a goal of providing all Canadians with access to high speed internet by 2030.

- Labour shortages: Rural Canada lacks a sufficient pool of workers across a broad range of skill sets and sectors.

- Inter-community mobility: Limited transit options between rural communities force continued reliance on personal vehicles (and create barriers for those without).

- Capacity: 60 percent of communities (the majority of which are rural) have fewer than five municipal staff to carry out a wide range of tasks across often large geographic areas.

Key Strategies & Approaches

- Rural economic development is a shared endeavour across multiple levels of government – federal, provincial/territorial, and municipal – as well as with Indigenous partners and non-profit and private sector stakeholders. Continued cooperation across government departments and sectors will be essential.

- A coordinated, ‘whole-of-government’ approach is needed to ensure that rural Canada’s needs and perspectives are incorporated into federal programs and policies.

- In support of this, the recently established Centre for Rural Economic Development provides important outreach and coordination, working with the six federal Regional Development Agencies and multiple other federal departments and agencies to support:

- Investments in local and regional infrastructure to support growth and sustainability;

- Broadband connectivity programs to meet the unique internet needs of rural and remote communities;

- Skills training, especially among youth, Indigenous and senior populations;

- Immigration initiatives that work with communities and employers to welcome newcomers, address labour shortages and enhance economic vitality;

- Tourism initiatives to harness the economic potential of Canada’s growing rural tourism sector, where 56 percent of Canada’s tourism jobs currently exist; and

- Investments and initiatives to improve access to affordable housing.

Overview of Rural Canada

Key Facts About Canada's Rural Communities

- About 20% of Canadians (1 in 5) live in small communities (1,000 to 30k population) or other rural areas

- GDP growth remains strongest in urban areas, but rural areas still produce almost 30% of GDP

- Rural economy is more goods-based

- There is a skills shortage in rural Canada

- Home ownership is stronger in rural areas

- High speed internet is mostly limited to densely populated areas

- Rural municipalities own 25% of all public infrastructure stock (up to 49% in some asset classes), but face asset planning and maintenance challenges

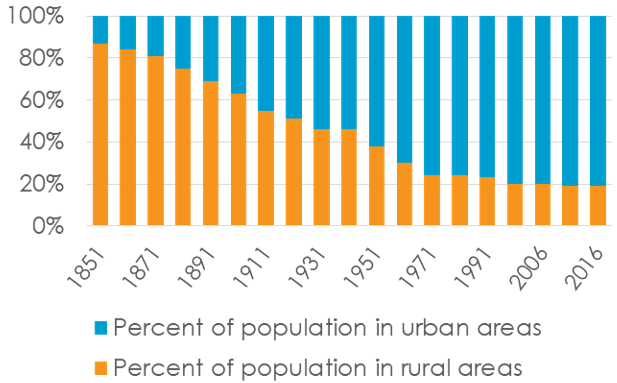

Demographics: there has been a population shift from rural to urban areas

- Canada’s urban population has increased over time, surpassing the rural population since the 1930s.

- In 2016, less than one-fifth of Canadians lived in rural areas.

- Some regions are more rural than others:

- Around half of Atlantic Canada is rural.

- The rural share of British Columbia, Ontario and Alberta is lower than the national average.

Urbanization in Canada, 1851-2016

Demographics: there are key demographic differences between rural and urban areas

- The average rural age is 43, compared to 40 for urban areas and 41 nationally.

- Just over one in twenty rural residents is an immigrant, compared to one in four urban residents.

- The share of Indigenous residents is higher in rural areas.

- There is variation among nations: over half of the Cree and Ojibwe nations are rural, compared to around one-third of Mi’kmaq, Algonquin and Mohawk nations

Population Pyramid (Rural and Urban Canada), 2016

![An opposing bar graph showing the distribution of age groups in rural and urban areas of Canada in 2016. Text version below [in data table].](/site/images/pd-dp/transition/graph2-eng.PNG)

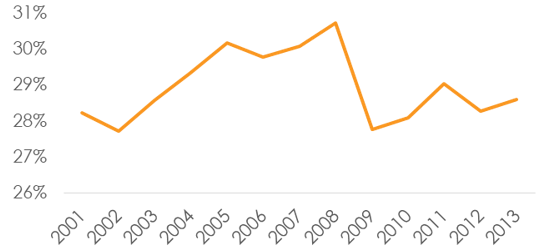

Economy: GDP per capita is higher in rural areas

- Historically, rural areas have accounted for about 27-30% of national gross domestic product (GDP).

- In 2013, GDP per capita was $49,360 in big cities (CMAs). It was 9% higher at $53,861 in rural areas (non-CMAs).

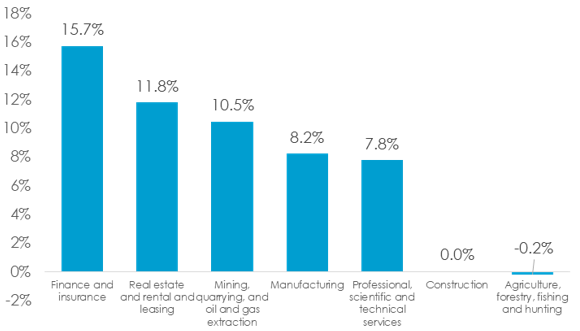

- GDP has grown the fastest in industries that tend to be centered in urban areas, while it has been virtually unchanged in primary industries and construction.

- Since 2013, Canada’s total output has grown by 8.2% -- with faster growth in the services sector (9.0%) than the goods sector (6.1%).

Share of National GDP in non-CMAs

GPD Growth by Select Industry (Chained 2012 Dollars), 2013 to 2017

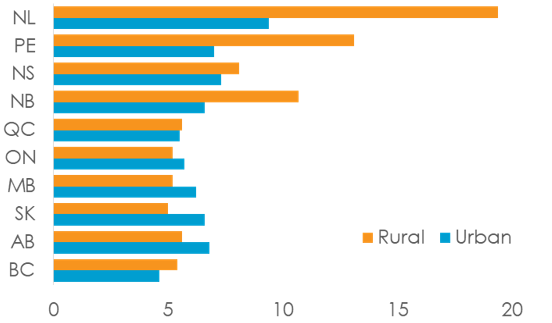

Economy: rural Canadians face higher unemployment rates and are more likely to work in declining industries

- Unemployment rates are generally higher in rural areas than urban areas.

- This disparity is greatest in Atlantic Canada.

- Rural men face higher unemployment rates than rural women (7.0% and 5.7% respectively).

- The rural economy is more goods-based than the urban economy.

- These jobs are declining: between 2011 and 2018, the number of jobs decreased by 5.4% in rural areas, while they increased 11.1% in urban areas.

Unemployement Rate by Province and Rural/Urban, 2018

Share of Total Employement by Sector, 2018

Skills and Education: university degrees are less common in rural areas

- Aging populations, youth out-migration and growth in urban-centred service industries, rural areas face a skills gap.

- Education plays an important role: among OECD countries, Canada has the largest rural-urban gap in educational attainment.

- Rural Canadians are less than half as likely as urban Canadians to have university degrees.

- Lower educational attainment makes it more difficult for rural Canadians to find higher paying jobs.

Highest Level of Educational Attainment in Canada, 2016

![Bar graph comparing the highest level of educational attainment for both rural and urban Canadians. Text version below [in data table].](/site/images/pd-dp/transition/graph7-eng.PNG)

Society and Health: rural Canadians are satisfied with their lives, but face lower health outcomes

- Rural Canadians are more likely to own their homes than the residents of every urban centre except Oshawa.

- 78% rural Canadians own their own homes, compared to 68% nationally.

- Just 16% of rural Canadians spend more than 30% of their income on housing, compared to 24% nationally.

- Homelessness is difficult to measure in rural areas, and may pose a greater concern than home ownership rates suggest.

Life Satisfaction score (out of 10), 2015-16

![Bar graph displaying the life satisfaction score out of 10 in 2015-16 for a variety of rural areas and major cities. Text version below [in data table].](/site/images/pd-dp/transition/graph8-eng.PNG)

Home Ownership: rural Canadians are more likely to own their homes

- Rural Canadians are more likely to own their homes than the residents of every urban centre except Oshawa.

- 78% rural Canadians own their own homes, compared to 68% nationally.

- Just 16% of rural Canadians spend more than 30% of their income on housing, compared to 24% nationally.

- Homelessness is difficult to measure in rural areas, and may pose a greater concern than home ownership rates suggest.

Home ownership rate, 2016

![Bar graph showing the percentage of home ownership rates in 2016 for various cities and rural home ownership nationally. Text version below [in data table].](/site/images/pd-dp/transition/home-ownership-2016.JPG)

Connectivity: high speed Internet is less common in rural areas

- In 2017, only 37% of rural households had access to 50/10 Mbps, compared with 97% of urban homes. Only about 24% of households in Indigenous communities had access to 50/10 Mbps.

- Existing initiatives are expected to bring the 50/10 Mbps coverage to 95 percent of Canadians by 2026, and the hardest-to-reach Canadians by 2030.

Download Speed Availability in Mbps, Urban vs Rural (% of Homes)

![Bar graph comparing the percentage of homes that have access to a range of internet speeds in 2017 based on whether located in urban or rural areas. Text version below [in data table].](/site/images/pd-dp/transition/graph14-eng.PNG)

Infrastructure ownership: rural Canada’s stock of infrastructure is greater than its share of the population

Ownership of Infrastructure by owner type, 2016

![Stacked bar graph comparing the ownership of various types of infrastructure by owner types (2016). Text version below [in data table].](/site/images/pd-dp/transition/graph15-eng.PNG)

- Rural municipalities own 25% of all public infrastructure stock (up to 49% in some asset classes), despite comprising less than a fifth of Canada’s population.

- In addition, much provincial, territorial and regional infrastructure serves rural communities.

Infrastructure: the rural stock of infrastructure is growing

- About half of all new roads, bridges and tunnels were built in rural municipalities in 2016.

- Rural municipalities are less likely than their urban counterparts to have asset management plans to manage these assets.

Share of new assets built in 2016 by owner type

![Stacked bar graph showing the percentage of total new roads, bridges and tunnels built in Canada during 2016, broken out by provincial/territorial/region, urban municipalities or rural municipalities. Text version below [in data table].](/site/images/pd-dp/transition/graph16-eng.PNG)

Prevalence of asset management plans by owner type

![Bar graph showing the prevalence of asset management plan in 2016 by owner type. Text version below [in data table].](/site/images/pd-dp/transition/graph17-eng.PNG)

Broadband Overview

OVERVIEW

Overwhelmingly, rural and remote communities have identified unreliable and slow internet connectivity as the number one issue impeding their economic growth. The need for improved internet and cellular connectivity is felt by rural and remote communities across the country, in every province and territory. High-speed Internet is regarded as critical for rural communities to enable economic growth, retain youth, attract talent, grow a business, and adopt new technologies.

Although all Canadian households have access to some form of internet access, Canadians living in rural and remote areas face significantly slower, less reliable Internet access than those in urban centres. In addition, there can be gaps in mobile connectivity, including along major roads and highways. The low population density and challenging terrain can make the business case for investing in rural areas challenging.

The federal government has had a series of broadband funding programs over the past two decades to help support rural connectivity in areas that lack a private sector business case. However, as the needs of Canadians continue to grow and evolve, continued support will be needed to make sure rural and remote areas do not fall further behind. The Canadian Radio-television and Telecommunications Commission (CRTC) has set high-level targets for high-speed Internet and cellular connectivity. There are several federal funding programs that support investment in areas where there is a lack of business case for the private sector. Other federal tools are also used to support access, such as regulation of spectrum frequencies (the critical public resource that is essential for wireless services), and to promote affordability of internet and cellphone plans for Canadians.

Funding for Rural Broadband

ISED Broadband Programming

- Responsible Department: ISED

ISED has put in place a series of programs to improve Internet access, including Broadband Canada (2009), Connecting Canadians (2014), and Connect to Innovate (2016).

More recently, ISED secured new funding, including $1 billion over 10 years for the next ISED broadband program. As ISED moves forward with the design of the new program, the department will build on existing collaboration with federal partners, provincial-territorial governments, the private sector, and Indigenous communities to help maximize benefits for Canadians.

ISED is also seeking to leverage new low-Earth orbit (LEO) satellite technology to deliver high-speed Internet services to Canada’s most remote and northern regions. LEO involves launching hundreds of satellites (a “constellation”) closer to the Earth than traditional satellites, offering greater capacity and improving performance considerably.

In July 2019, the Minister of ISED announced the signing of a Memorandum of Understanding (MOU) with Telesat to invest up to $600 million to secure broadband capacity over Canada from its planned LEO satellite constellation. The initiative remains subject to Treasury Board approval and reaching the final terms of a contribution agreement.

Rural & Northern Communities Stream

- Responsible Department: Infrastructure Canada

Broadband infrastructure projects are eligible for funding under the Rural and Northern Communities Stream of the Investing in Canada Infrastructure Program (ICIP). To date, the stream has been used by to support significant broadband projects in PEI, Quebec and Nunavut.

The ICIP is a ten-year, $33.1 billion program providing funding for public infrastructure initiatives across Canada. It is managed through Integrated Bilateral Agreements (IBAs) with the provinces and territories. In consultation with municipalities and Indigenous communities, the provinces and territories are responsible for identifying, prioritizing and submitting projects and flowing funds to eligible ultimate recipients.

The ICIP is divided into four funding streams: Public Transit ($20.1 billion); Green Infrastructure ($9.2 billion); Community, Culture and Recreation Infrastructure ($1.3 billion); and Rural and Northern Communities Infrastructure ($2 billion + $400 million).

CRTC Broadband Fund

- Responsible Agency: CRTC

The CRTC has created a $750 million fund to support the rollout of broadband to rural and remote households. On June 3, 2019 the CRTC launched its first call for applications, which focusses on broadband and mobile connectivity projects in the three territories and satellite dependent communities across Canada. The deadline to submit applications for the first call was October 3, 2019. The CRTC has launched a second call for applications that is open to all types of projects in all eligible geographic areas, and expects that projects will be announced in 2020. Applicants have until March 27, 2020, at 5 pm PST to apply.

As an independent administrative tribunal, the CRTC operates at arms-length from federal departments.

Canada Infrastructure Bank (CIB)

- Responsible Department: Infrastructure Canada

The Canada Infrastructure Bank (CIB) uses federal support to attract private sector and institutional investment to new revenue-generating infrastructure projects that are in the public interest, including broadband infrastructure. By leveraging the capital and expertise of the private sector, the Bank is intended to be an additional tool that provincial, territorial, municipal and Indigenous partners can use to build infrastructure across Canada.

The CIB is a Crown corporation that operates at arm's length from government and is governed by a Board of Directors.

Affordability of Internet/Cellphone Plans

The competition between telephone and cable networks, as well as suppliers of satellite, wireless and other telecommunications services, has given Canadians a variety of choice in terms of both price and quality. As competition and technology evolve, fibre, wireless mobile networks, and high throughput satellites are expected to provide Canadians across the country with even faster internet speeds and higher quality services.

Recent spectrum auctions have also been designed to enable regional competitors to expand and strengthen their networks to better compete. On April 4, 2019, ISED concluded its 600 MHz spectrum auction. The 600 MHz auction set aside 43 percent of spectrum for regional competitors and new wireless market entrants. The auction succeeded in supporting wireless competition, with regional competitors acquiring 40 licenses, across all 16 geographic areas, meaning all regions of Canada can expect to see more vigorous competition.

The CRTC has also put in place policies and regulations that encourage competition and choice. For example, the CRTC requires the large telephone and cable companies to lease portions of their networks to their competitors, at regulated wholesale rates. As a result, a number of smaller Internet service providers have entered the market and often offer greater choice and lower prices for Internet services. A recent study found that average broadband Internet prices offered by smaller service providers were up to 35 percent lower than those of the large companies.

Spectrum and Wireless Coverage

- Responsible Department: ISED

Access to spectrum for wireless technology is a key component of connectivity for rural homes and businesses, particularly in areas where wireline solutions are not feasible. ISED has developed spectrum management policies to encourage rural coverage or to increase access to spectrum for rural operators.

Promoting Competition: ISED has taken a number of steps that respond directly to concerns raised by smaller rural service providers. Earlier this year ISED introduced smaller licensing areas (known as Tier 5) that will make it possible to licence spectrum in small areas that rural providers could more easily afford. Changes were also made this summer to the fee structure for wireless backhaul, which will reduce a significant recurring cost for many rural/remote broadband providers.

Promoting deployment in rural areas: In order to support the provision of high-quality services in rural and remote areas, ISED is executing its plans to make additional spectrum available for broadband services and to facilitate access to spectrum. Its next spectrum auction (3500 MHz) is planned for 2020, and the consultation currently underway asks a number of questions that pertain to rural connectivity.

ISED will continue to make additional low, medium and high frequency spectrum available to support the deployment of new technologies such as 5G, as well as to introduce measures to improve access in rural and remote areas such as smaller licence tiers, lower licence fees, and a modernized satellite framework.

- Date modified: